Estimated tax payments 2021 calculator

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. 250 if marriedRDP filing separately.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

In addition extension return and bill payments can also be made.

. 1040 Tax Estimation Calculator for 2022 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes. 2021 Online 1040 Income Tax Payment Calculator. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

Generally you must make estimated tax payments if in 2022 you expect to owe at least. As a partner you can pay the estimated tax by. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Make ALL of your federal tax payments including federal tax deposits FTDs installment agreement and estimated tax payments using EFTPS. United States Federal Personal Income Taxes Estimator Estimate How Much You Owe the Federal Government Need to Pay to the IRS in. Visit the MassTaxConnect video tutorial How to Make an Estimated Payment.

One notable exception is if the 15th falls on a. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. To calculate your estimated taxes you will add up your total tax liability for the current yearincluding self-employment tax individual income tax and any other taxesand divide.

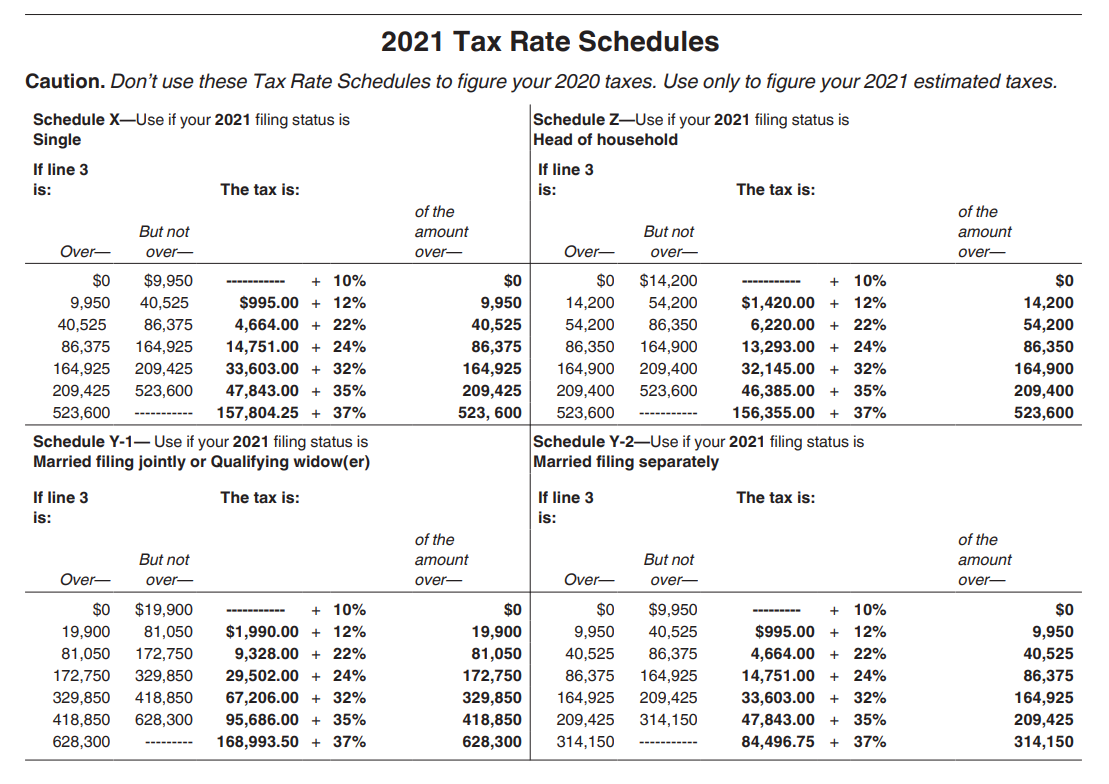

Tax Calculator 2021 Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates.

Enter your income and location to estimate your tax burden. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. And you expect your withholding and credits to be less.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. These rates are the default unless you tell your payroll provider to use a. If you expect to owe more than 1000 in taxes thats earning roughly 5000 in self-employment income then you are required to pay estimated taxes.

Our calculator uses the IRS standard withholding rates to estimate whats withheld from your paycheck annually. Current Revision Form 1040-ES PDF Recent Developments Using a Social Security Number SSN or Individual Taxpayer Identification Number ITIN When Paying Your Estimated Taxes -- 28. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. 0 Estimates change as we learn more. Based on your projected tax withholding for the.

Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. Tax filing status Taxable gross.

To avoid a penalty your estimated tax payments plus your withholding and refundable credits must equal any of these. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

TurboTax Offers A Free Calculator For You To Easily And Accurately Estimate Your Taxes. If its easier to pay your estimated taxes. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. 90 of your current years original tax liability 667 if you are a. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self.

Crediting an overpayment on your. This simple calculator can help you. We can also help you understand some of the key factors that affect your tax return estimate.

Use Form 1040-ES to figure and pay your estimated tax for 2022.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Pin Page

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Quarterly Tax Calculator Calculate Estimated Taxes

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Aca Penalty Calculator Health Insurance Coverage Full Time Equivalent Employment

Quarterly Tax Calculator Calculate Estimated Taxes

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Income Tax Refund In 2022

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Pin Page

Komentar

Posting Komentar